-

|

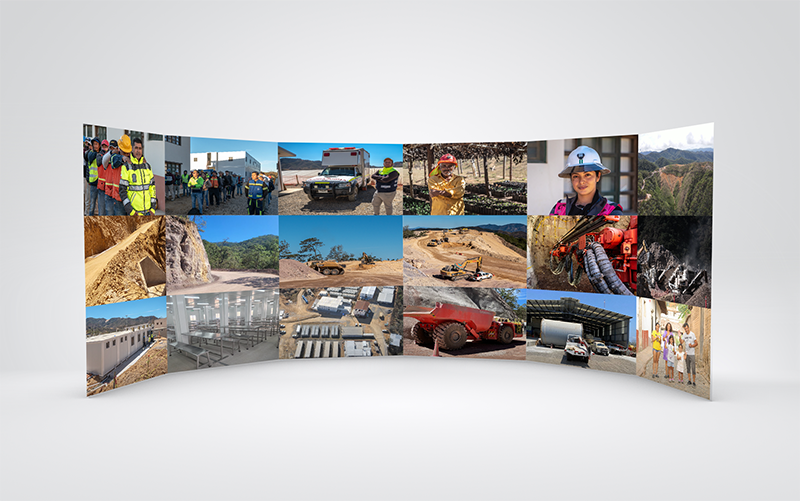

With our exciting Terronera Project commencing wet commissioning, Endeavour Silver is leading Mexico’s next silver mining development.

In Jalisco, Mexico, our Terronera mine has commenced wet commissioning, with an expected 10-year mine life. The project will bring significant economic benefits to the local area and Endeavour Silver will be advancing economic development in a sustainable and responsible way. Terronera is set to become our flagship operation and Mexico’s next producing silver mine.

Responsible Development

Mexico is one of the world’s premier mining jurisdictions with a long history of successful mining. The Terronera project is an original discovery that has grown in size and scale over the last decade. While the concept of building a new mine is complex, it is also extremely exciting for bringing more employment and business opportunities, as well as improved infrastructure to a local area. At the same time, Endeavour Silver is committed to supporting the economic activities in the region in a sustainable way.

Our Terronera Project is being developed in the San Sebastian mining district in Jalisco state, Mexico. It is located within the Sierra Madre volcanic belt, which hosts most of Mexico’s gold and silver deposits. It is a low-sulphidation epithermal vein system that will be mined using a combination of long hole and cut and fill techniques. The underground mine consists of two deposits, Terronera and La Luz, which will feed a centralized 2,000 tonne per day process plant. Based on the Feasibility Study, Terronera is expected to produce 4 million ounces of silver and 38,000 ounces of gold annually over its 10-year life.

Mexico is one of the world’s premier mining jurisdictions with a long history of successful mining. The Terronera project is an original discovery that has grown in size and scale over the last decade. While the concept of building a new mine is complex, it is also extremely exciting for bringing more employment and business opportunities, as well as improved infrastructure to a local area.

Endeavour Silver is committed

to supporting the economic

activities in the region in a

sustainable way.Learn more:Terronera Website mEducation

Community

infrastructureLocal economic

developmentEnvironment

- Home

- Quiénes somos

- Sustentabilidad

- Inversionistas

- Noticias & Media

- Careers

© 2025 Endeavour Silver Corp.

All rights reserved.