-

|

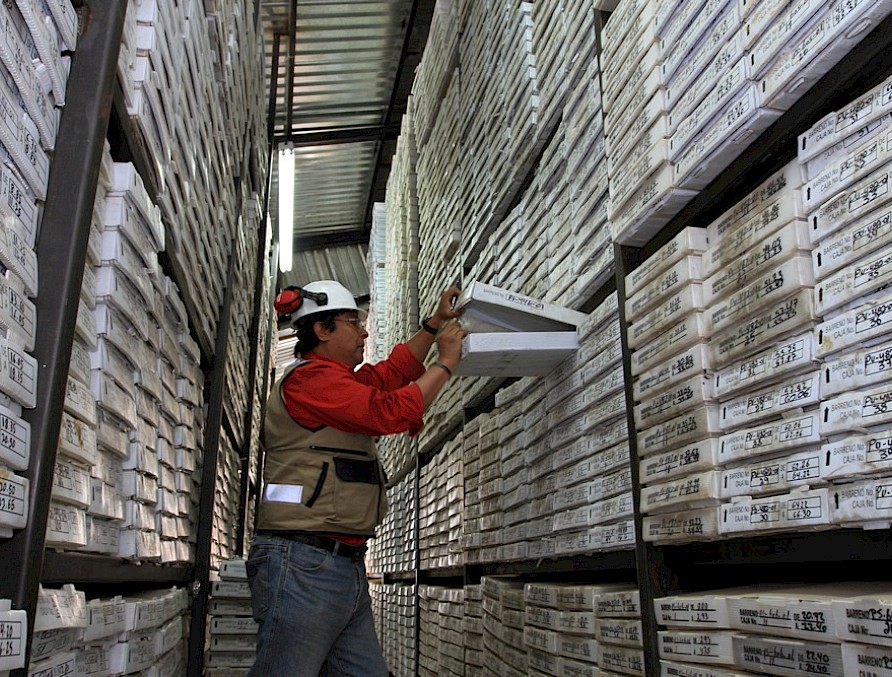

Our cornerstone asset is a high-grade underground silver mine with significant exploration upside to provide sustainable production and future growth

Guanaceví, our first and highest-grade silver mine

Acquired by Endeavour Silver in 2004, Guanacevi is our first and highest-grade silver mine. It is located in a historic silver mining district in Durango, situated in northern Mexico. Shortly after the acquisition closed, management discovered the first high-grade orebody and production commenced in 2005.

The mines were developed using mechanized underground ramp access and plant capacity was expanded by 100% to 1200 tpd. To date, the Company has discovered a total of eight new orebodies along the 5km length of the prolific Santa Cruz vein. Currently, Guanaceví provides steady employment to over 500 people and engages approximately 400 contractors.

In 2019, following the implementation of financial improvement measures, Guanaceví completed an operational turnaround that materially improved mine profitability. The development of two new orebodies – Milache and Santa Cruz Sur (SCS) – together with the acquisition of the Ocampo concession mining rights covering the El Curso property, have provided sufficient ore and flexibility to increase mine output and achieve plant capacity. The El Curso concessions are subject to a sliding scale royalty based on realized silver prices and are payable to a subsidiary of Groupo Frisco.

Currently, there are three orebodies being mined at Guanacevi: El Curso, Milache, and Santa Cruz Sur. Additionally, we allow for up to 20% of total ore milled to be purchased from local artisanal miners.

At Guanaceví, 2024 plant throughput is estimated to range from 1,150 tonnes per day (tpd) to 1,250 tpd and average 1,200 tpd mining mainly from the Porvenir Cuatro extension on the El Curso concessions. The El Curso concessions were leased from a third party with no upfront costs, but with significant royalty payments on production. Compared to 2023, mine grades are expected to be slightly lower and recoveries are anticipated to be similar in 2024. Cash costs per ounce, AISC per ounce and direct costs1 on a per tonne basis are expected to be similar to 2023.

Operating Data

2023 2022 2021 2020 Silver produced (oz) 5,105,237 5,340,553 4,333,567 3,071,075 Gold produced (oz) 14,955 15,735 13,317 9,814 Silver equivalent metal (oz) 80:1 ratio 6,301,637 6,599,353 5,398,927 3,856,195 Ore processed (t) 433,409 412,303 414,355 346,679 Silver/gold grade (g/t) 417/1.19 465 / 1.33 370 / 1.09 314 / 0.96 Cash operating costs ($/oz sold) 1 - $11.46 $12.12 $10.44 All-in sustaining costs ($/oz sold) 1 - $18.43 $19.46 $17.14 1 These are examples of Non-IFRS Financial Measures. Please refer to the Non-IFRS Measures section of the Company’s Management’s Discussion & Analysis for further information and definitions of these terms.

The principal mineralization within the Santa Cruz-Porvenir mines is an epithermal low-sulfidation, quartz carbonate, fracture-filling vein hosted by a fault-structure that trends approximately N45°W and dips 55° southwest. The fault and vein comprise a structural system referred to locally as the Santa Cruz vein structure or Santa Cruz vein fault. The Santa Cruz vein structure has been traced for 5 km along the trend and averages about 3 m in width. Mineralization in the system is not continuous, but occurs in steeply northwest-raking shoots up to 200 m in strike length. A second vein, sub-parallel to the Santa Cruz vein but less continuous, is economically significant in the Porvenir Dos zone and in the northern portion of deep North Porvenir. It is referred to in both areas as the “Footwall vein”, although in Porvenir Dos, the term “Conglomerate vein” has also been employed.

The Guanaceví silver-gold district comprises classic, high-grade silver-gold, epithermal vein deposits, characterized by low sulphidation mineralization and adularia-sericite alteration. The Guanaceví veins are typical of most other epithermal silver-gold vein deposits in Mexico in that they are primarily hosted in the Tertiary Lower Volcanic series of andesite flows, pyroclastics and epiclastics, overlain by the Upper Volcanic series of rhyolite pyroclastics and ignimbrites. Evidence is accumulating in the Guanaceví mining district that the mineralization is closely associated with a pulse of silicic eruptions that either signaled the end of Lower Volcanic Sequence magmatism or the onset of Upper Volcanic Sequence activity. Low sulphidation epithermal veins in Mexico typically have a well-defined, sub-horizontal ore horizon about 300 m to 500 m in vertical extent where the bonanza grade ore shoots were deposited due to boiling of the hydrothermal fluids. Neither the top nor the bottom of the Santa Cruz ore horizon has yet been found.

© 2024 Endeavour Silver Corp.

All rights reserved.