-

Your Questions, Our Answers

Q:The silver price in USD is currently trading near its 3 year lows, why?

Back to the media page m Silver prices in USD have fallen sharply this year, so to understand why we need to look at both silver supply and demand, as well as macro-economic factors.

Silver prices in USD have fallen sharply this year, so to understand why we need to look at both silver supply and demand, as well as macro-economic factors. Silver supply – after falling for two consecutive years, silver supply is looking to be flat in 2018. However, new mine supply is dominantly (70%) a byproduct of copper, lead-zinc and gold mines, and those commodities recently came through a 5 year bear market, so there is a lack of new copper, lead-zinc and gold mines being developed and therefore less foreseeable growth of byproduct silver supply. Recycled silver supply has also been declining in recent years because people only sell old silver coins, jewelry and silverware when prices are high and rising. So silver supply is not the reason why the silver USD price has dropped this year.

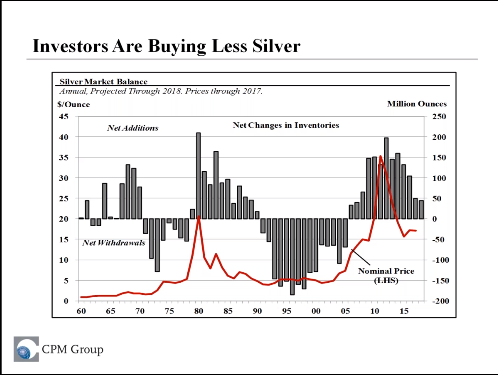

Silver demand – it looks like silver demand will fall for the third consecutive year in 2018. However, electronic demand continues to power higher, up 3% this year, offset by a slow-down in solar photovoltaic offtake, so industrial demand was relatively flat in 2018. However, investors are on track to buy only 50 million ounces this year, down from 200 million oz in 2012. With coin and bar demand down 12% and jewelry demand down 1%, investment demand appears to be the primary reason for the drop in silver USD price this year.

Macro-economic factors – we have to look to macro-economic factors to explain why investors reduced their purchases of physical silver. The USD has strengthened 8% since May so all commodity prices have fallen since then. So what will reverse this trend? A weaker USD! There are now many signs that the upward move in the USD is now behind us with US Fed announcing their interest rates are close to neutral, the US equities in the middle of a correction, and the bond yield curve is flattening.

Longer term view – We think the lack of new byproduct silver mine supply, coupled with the return of investment demand, could set up a “perfect storm” for silver. Gold has already come off bottom and wherever gold goes, silver follows. In 2018, investors moved into the US dollar as a safe haven given the market volatility introduced by the recent currency wars and trade tariffs. As the USD weakens, gold and silver prices will strengthen.

Source of info: CPM Group

This CEO question includes examples of Forward Looking Statements. Please refer to Cautionary Forward Looking Statements in the Company’s MD&A posted on the website for details.

- Home

- About

- Portfolio

- Sustainability

- Investors

- News & Media

- Blog

- Contact

- Careers

© 2025 Endeavour Silver Corp.

All rights reserved.

Cookies are used to make this website work and to enhance your experience. To learn more about the types of cookies this website uses, see our Cookie Policy. You can provide consent by clicking the "I Consent" button or by canceling this cookie notice.

Cookies are used to make this website work and to enhance your experience. To learn more about the types of cookies this website uses, see our Cookie Policy. We need your consent to use marketing cookies. Marketing cookies are used to track visitors across websites. The intention is to display ads (via third party services) that are relevant and engaging for individual users. Please select the checkbox below to indicate your consent.